34+ deductible mortgage interest 2021

Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals. Web The Mortgage Debt Relief Act of 2007 excludes any discharged debt up to 2 million for peoples primary residences.

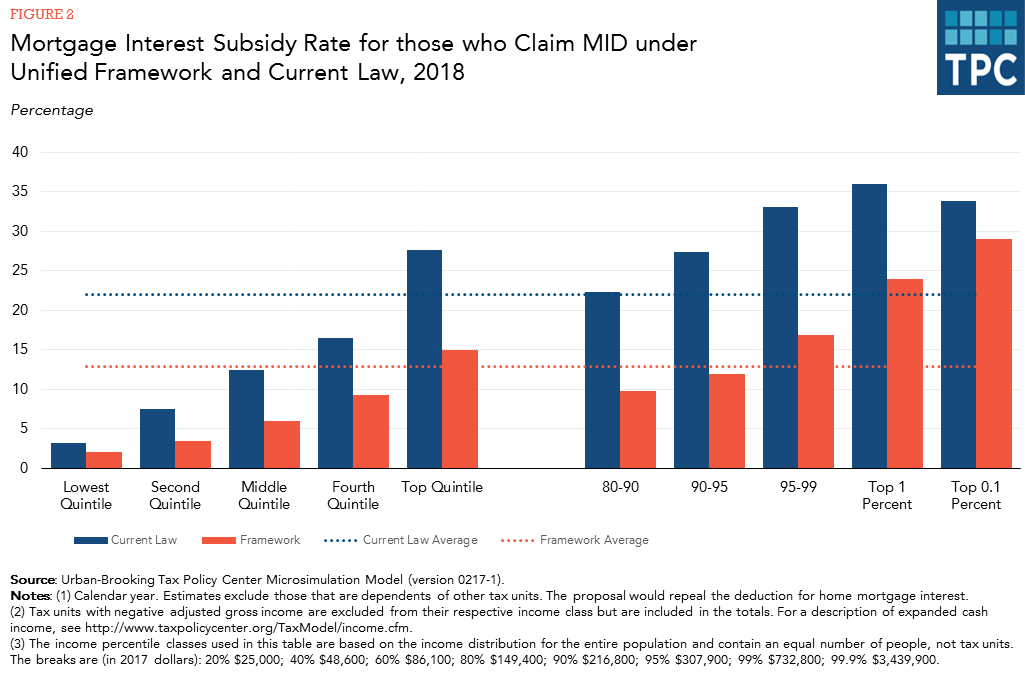

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Web Is mortgage insurance tax-deductible.

. Most homeowners can deduct all of their mortgage interest. Generally homeowners may deduct interest paid on HELOC debt up to a max of. As a result most homeowners wont need to.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Homeowners who bought houses before. Feb 10 2021 May 06.

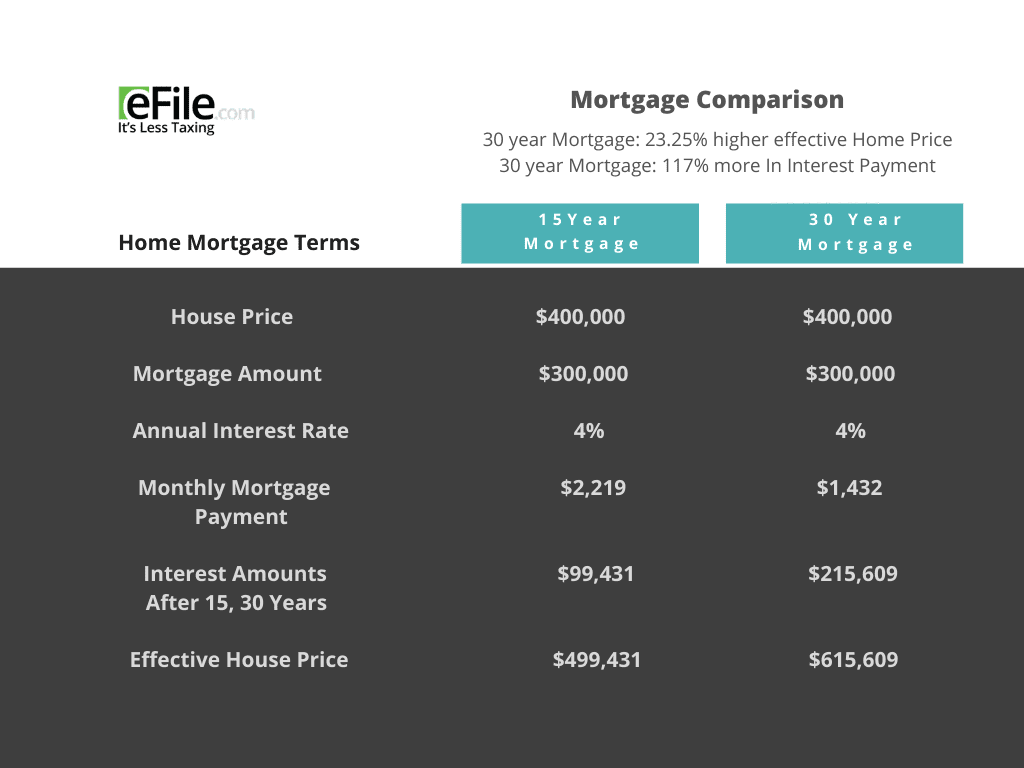

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. However you cannot deduct the prepaid amount in 2021 even. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web Mortgage interest deduction issues. For tax years before 2018 the interest paid on up to 1 million of acquisition. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web All the details on the HELOC mortgage deduction limits in 2020 and 2021. Web Deductible Home Mortgage Interest Wks.

Web If you prepaid interest in 2021 that accrued in full by January 15 2022 this prepaid interest may be included in box 1. Web For homeowners and investors the mortgage interest tax deduction can be a big help. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Ad Calculate Your Payment with 0 Down.

Web Is Mortgage Interest Tax Deductible in 2022 and 2023. Learn about the rules limits and how to claim it. Web How much interest can I claim.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows. I am having 2 issues regarding the mortgage interest deduction that I could use some clarification on. This form has not been finalized for returns with two or more mortgages and limited mortgage interest.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

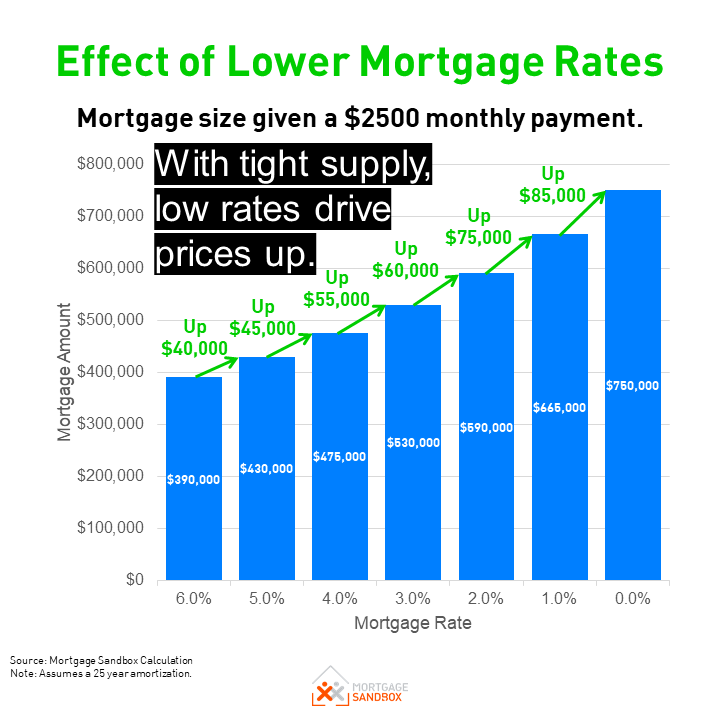

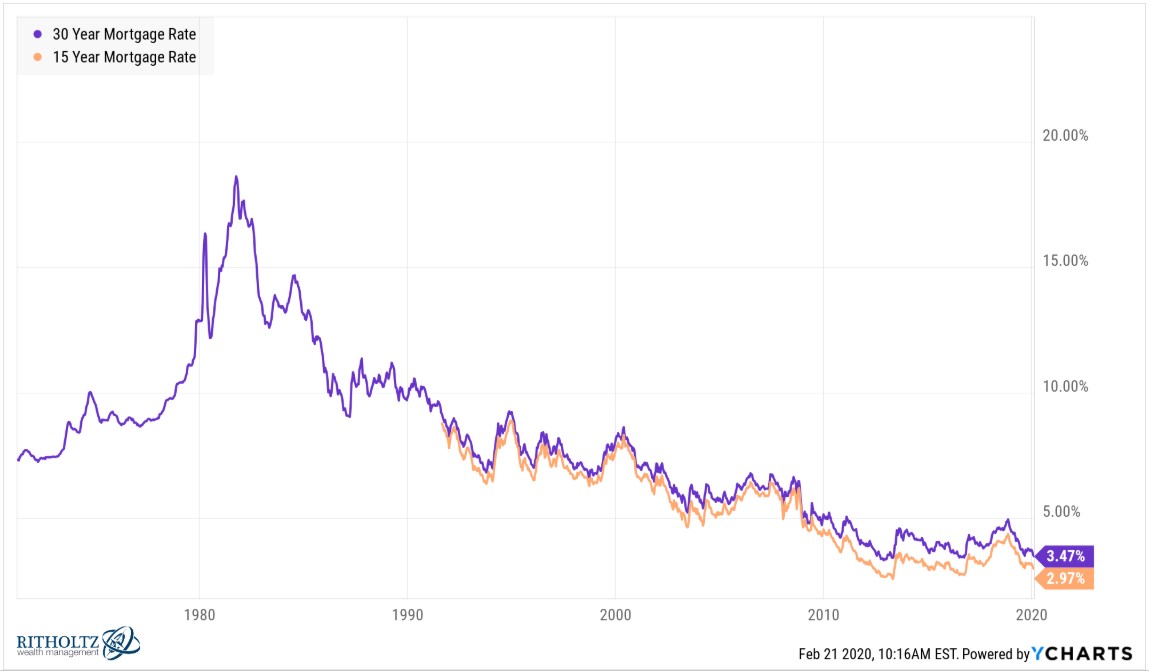

Mortgage Rate Forecast To 2023 Mortgage Sandbox

Mortgage Interest Deduction A 2022 Guide Credible

Should You Pay Off Your Mortgage Early With Rates So Low

Mortgage Interest Deduction Bankrate

Is Mortgage Interest Deductible In 2023 Consumeraffairs

Mortgage Statement 10 Examples Format Pdf Examples

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Home Mortgage Loan Interest Payments Points Deduction

Maximum Mortgage Tax Deduction Benefit Depends On Income

Mortgage Statement 10 Examples Format Pdf Examples

The Home Mortgage Interest Deduction In 2021 How To Deduct Your Mortgage Interest Youtube

Ex 99 1

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Mortgage Interest Deduction Bankrate

Home Mortgage Loan Interest Payments Points Deduction